Brief history of the Hungarian Forint

The currency of Hungary is called “forint” which was already in use in medieval Hungary along with other European countries.

Hungary experienced hyperinflation (the world's highest to date: 1016% per month) in 1945 and 1946 after World War II, and "pengő" [ˈpɛŋɡøː] – the currency adopted in 1927 – had completely lost its value. Thus, forint was reintroduced in August 1946 as a currency to replace the pengő. The subunit of forint is called “fillér” [ˈfilleːr] – 1 forint could be divided into 100 fillers. However, due to inflation and other economic factors after the end of socialism, fillér was put out of use in 1999.

Hungary joined the European Union in 2004. The conditions for joining the EU include adopting the euro, hence it being the common currency of the union, however, no deadline is set in stone within the rule. Hungary has not made this step yet and continues operating with its own currency to this day.

There have been discussions to introduce the euro many times in the past, but after witnessing the Greek government-debt crisis, neither the pros or cons have outweighed each other. The current Hungarian government is reluctant to carry out the measure of adopting the euro, so we can assume that the forint will continue to be used for a while a longer.

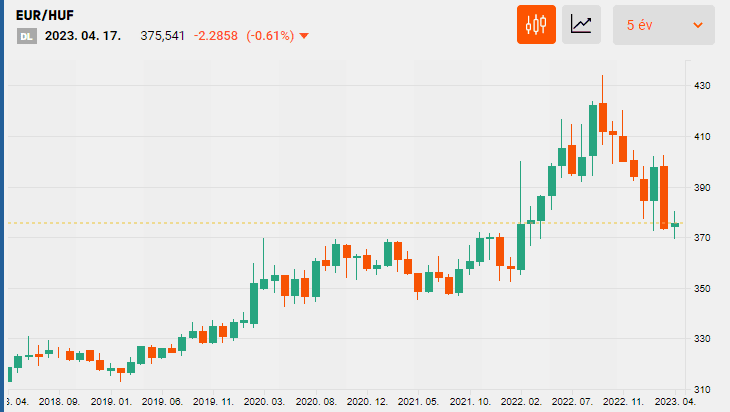

The forint is considered to be an "emerging currency" in the world; it is used in the (relatively) small country of Hungary with a population of less than 10 million people. As such, it can be expected to be sensitive to certain global events and exchange rate fluctuations. Forint exchange rates are often shown in pair with the euro on different kinds of platforms, as forint is mostly traded for euro. As of April 2023, 1 EUR = 371 HUF.

Why is the Hungarian Forint becoming weaker and weaker?

The Central Bank of Hungary, in line with global trends, started adopting a low interest rate policy in 2011. Interest rates stood at 7% in 2011, then were gradually reduced to 0.9% by 2016. They were held steady and low at 0.9% for 4 consecutive years from 2016 to 2020. As a consequence, the forint has been progressively depreciating in this period (300~310 HUF to 1 EUR in 2015, 320~330 HUF to 1 EUR in 2019).

Speaking of the government’s fiscal measures, many policies have been introduced that stimulated demand (such as low-interest loans), so the supply of the forint continued to increase while interest rates remained low. Although it was not acknowledged, the weakening of the Hungarian forint seemed to be part of the country's economic policy.

Since exports are the driving force of Hungary's economy, the forint's depreciation is presumed to have had some positive effects. During the time period mentioned above, Hungary's economic growth was considered to be high, and even though there was inflation to a certain extent (around 2-3%), real wages have also increased. On the other hand, the Hungarian forint's currency value fell 23.81% against the euro between January 2011 and January 2020.

What was the impact of the coronavirus?

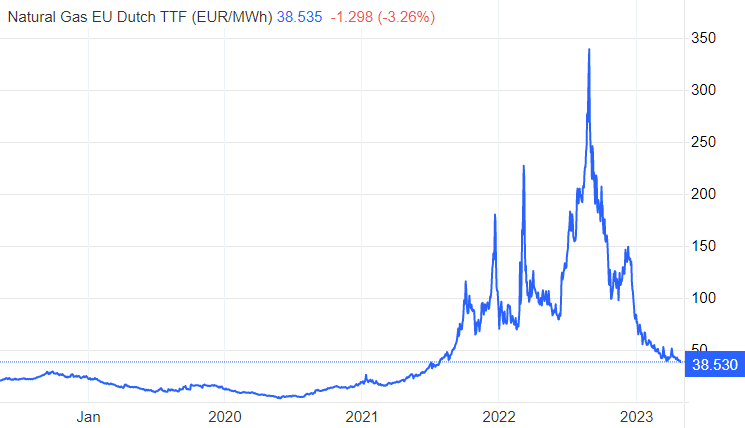

With the start of the global pandemic and economic crisis in March 2020, the Hungarian forint exchange rate swayed. In March 2020 alone, the forint dropped about 8%. After that, it continued to fluctuate up and down, and in October 2022, it fell to the record-low of 1 EUR = 430 HUF level due to the rising prices of the post-corona period, high energy prices, and concerns about the Russian-Ukrainian war that started in February 2022. This represents a further 25.45% drop in the Hungarian forint exchange rate compared to January 2020. This time, forint depreciation seemed unstoppable. The forint was among the world's worst performing currencies.

How did the Hungarian Central Bank respond to the sharp exchange rate depreciation?

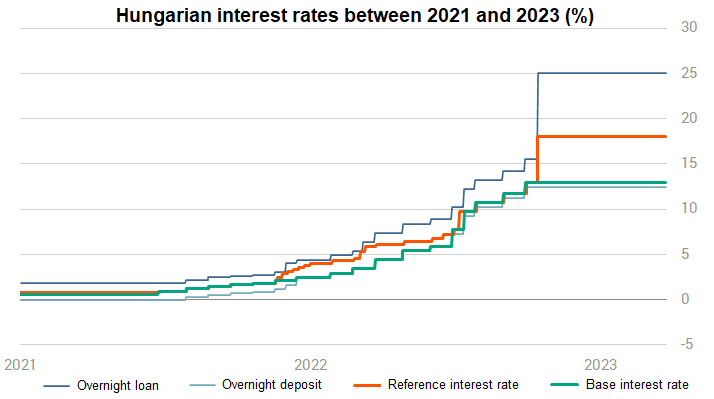

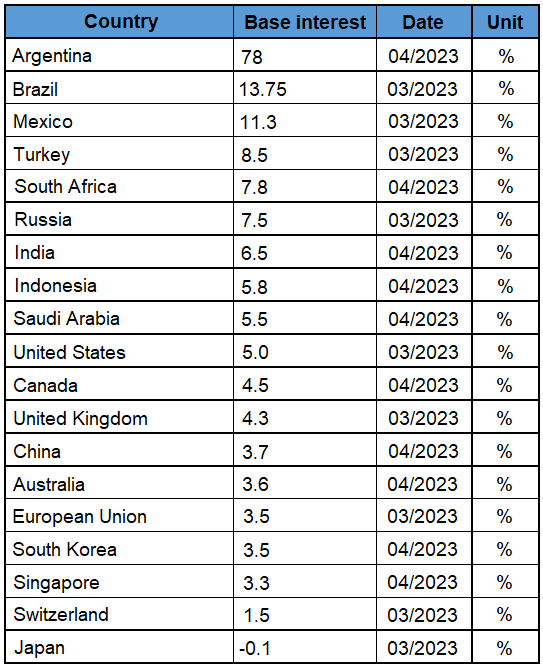

After June 2021, interest rates began to rise in inverse proportion to the Hungarian forint's exchange rate. The base rate was raised from 0.6% to 13% between July 2020 and September 2022 – in a mere 2 years. However, as of April 2023, the overnight interest rate is 18% which is currently functioning as the actual interest rate (reference interest rate). At the moment, Hungarian interest rates are considered to be high in terms of global comparison, too.

For a long time, the Hungarian Central Bank's interest rate hike could not stop the Hungarian forint from falling. The base rate peaked at 13% in September 2022, and the forint kept falling despite the overnight rate rising to 18% in October the same year.

The forint exchange rate started improving after energy prices fell in December 2022 and visible signs pointing to the end of the European energy crisis were seen. Hungary is extremely dependent on imports, especially energy – which is generally purchased with foreign currency. This means that when energy prices are high, the purchasing demand for Hungarian forint on the currency market rises, which negatively affects its exchange rate.

The setting of higher interest rates has taken effect once concerns about energy supplies eased in 2023. The Hungarian forint strengthened by 7% against the euro and 9% against the US dollar between January and April 2023. In contrast to 2022, the first half of 2023 was the time of the forint revival.

There are many uncertainties about how the Hungarian forint rate's currency power will change in the future. The tightening monetary policy of the Hungarian Central Bank has led to higher interest rates on various loans in Hungary, and the burden of government bonds has increased as well. Also, high interest rates generally have a slowing effect on a country's economy. Therefore, there is strong pressure put on the central bank by the government to lower high interest rates.

However, Hungary's Central Bank is in an even more difficult position, since domestic inflation is still high. Unless major economies will not start cutting interest rates, preceding these countries with lower interest rates could trigger yet another wave of depreciation for the Hungarian forint.

Therefore, economic trends around the world, Hungary's inflation rate, and the rise of energy prices in 2023 will be the most important factors impacting the Hungarian forint in the coming years. The same way Hungary has to coexist with other countries as an open economy – in the sense that Hungary has a narrow domestic market and it mainly relies on trade –, its currency, the forint, is also destined to be affected by global trends in general.

How does the change in the Forint’s currency power affect foreign companies in Hungary?

The depreciation of the Hungarian forint between 2011 and 2020 was moderate, and in some ways, predictable. This was also beneficial for foreign companies investing in Hungary making their financial planning in EUR, USD or JPY. For example, Hungarian salaries have risen, but only in HUF – in EUR, the amount has stayed almost the same. Hungary's forint-denominated domestic service inflation was also less impactful than expected.

On the other hand, Hungarian forint exchange rate fluctuations have been wild and difficult to predict since 2020. Not knowing how the currency power changes makes financial planning difficult and poses a management risk – in the long run, a stable rate is more desirable. This applies to foreign and Hungarian companies as well.

Considering that energy prices have now stabilized to a certain extent, it is assumed that there will be fewer sudden changes in the Hungarian currency's value. Plus, given the long-term trends, the forint still has a bigger possibility to fall instead of rising, which could be beneficial factor for future investors.

Sources

- https://hu.wikipedia.org/wiki/Magyar_forint

- https://hu.wikipedia.org/wiki/Magyar_peng%C5%91

- https://portfolio.hu/

- https://tradingeconomics.com/commodity/eu-natural-gas

- https://tradingeconomics.com/country-list/interest-rate

If you have any questions, please feel free to contact us!

If you are interested in hearing more information about the current state of economic circumstances, market conditions and business opportunities in the Central and Eastern European region including Hungary, contact us!