Japan, as the world's 4th largest (GDP - 2025) economy, presents both immense opportunities and challenges for European companies. With a strong local competition, emphasis on quality, reputation, and long-term relationships, entering the Japanese market requires careful strategy and persistence.

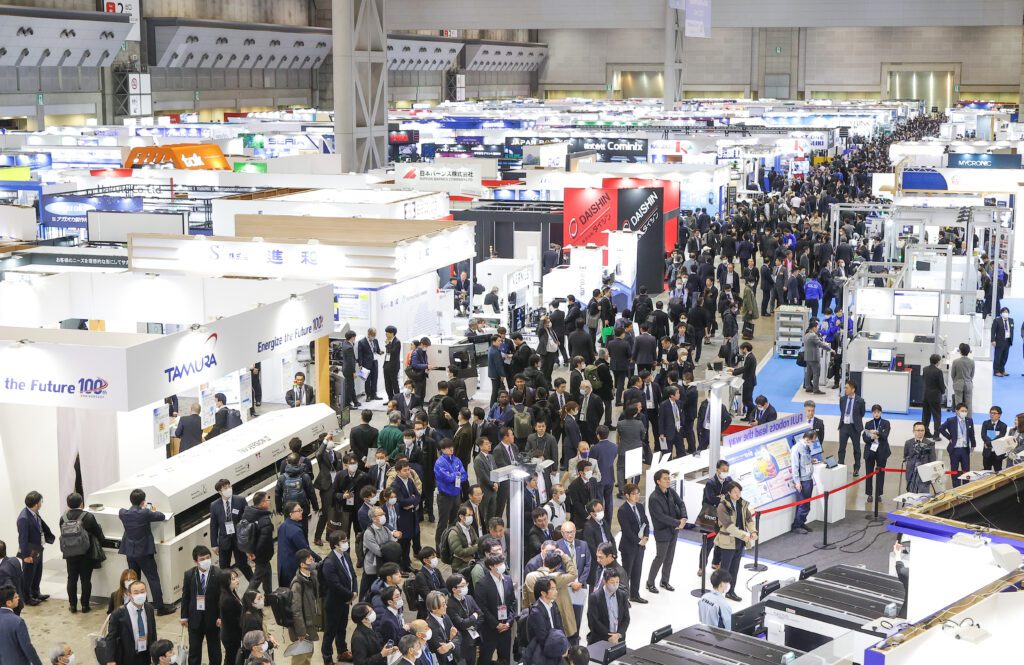

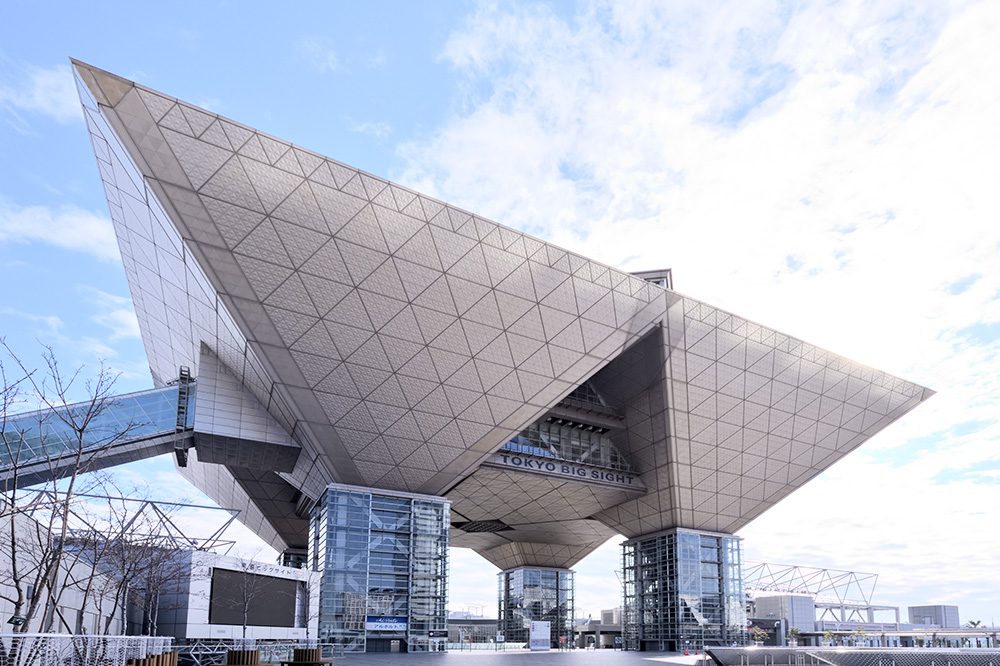

When it comes to how to enter the Japanese market, participating in exhibitions and trade fairs is one of the most effective strategies. They help you establish credibility and make meaningful B2B business connections. These events offer an invaluable opportunity to meet potential Japanese partners, gain industry insights, and showcase your products to a highly engaged audience.

Benefits of Trade Fairs in Japan for European Businesses

Unlike cold outreaches, which typically have a very low success rate for European companies trying to enter the Japanese market, face-to-face interactions are different. Meeting people at trade shows helps bridge cultural and business gaps. This makes it much easier for you to gain trust and recognition.

Key benefits of participating in Japanese trade fairs include:

- Market Validation: One of the biggest challenges for European businesses entering Japan is understanding local consumer preferences. Trade fairs provide direct feedback from Japanese buyers, distributors, and industry professionals, allowing companies to refine their offerings based on real market demand. This insight is crucial for tailoring products and services to meet Japanese expectations.

- Brand Awareness: Japanese consumers and businesses place great value on familiarity and reputation. Trade fairs offer a chance for you to present your brand to a highly targeted audience actively seeking new products and solutions. Being present at a recognized industry event can significantly improve credibility and long-term brand positioning. It can also be a good reference when discussing with potential partners or customers.

- Networking Opportunities: In Japan, strong business relationships are built through trust and repeated interactions. Trade fairs facilitate direct connections with potential distributors, partners, and suppliers who may be difficult to reach through traditional outreach methods. These in-person meetings create a foundation for long-term partnerships and future negotiations.

- Competitor Analysis: Since the Japanese market is a very competitive one with many local and international players, understanding the competitive landscape is essential for success. Trade fairs provide a first-hand look at competitors, their market positioning, and their unique selling points. This knowledge enables you to adjust your strategies and differentiate yourself effectively.

- Regulatory Insights: Japan has strict industry regulations that can pose significant challenges for new entrants. Trade fairs often feature seminars and discussions with industry leaders and government officials, providing valuable information on compliance, certification requirements, and legal frameworks. Gaining an early understanding of these factors can prevent costly mistakes and delays.

Visitor vs. Exhibitor: How to Choose the Right Participation Style at a Trade Fair

When considering a trade fair in Japan, you can participate either as a visitor or an exhibitor. The choice should align with your business objectives.

Participating as a visitor is often free of charge with a simple online registration. This option allows you to learn more about the industry, observe market trends, and conduct competitor research. However, if the goal is to sell products or find partners, attending as a visitor may not be the most effective approach. Unlike in Europe, where trade fairs often serve as active marketplaces, Japanese exhibitors primarily focus on promoting their own products rather than purchasing new ones. As a result, approaching them as a visitor with sales intentions may not yield favorable results. Also, keep in mind that being “pushy” almost never works on the Japanese market.

For businesses entering Japan, having a dedicated booth at a trade fair is a strong strategy. Although more expensive, it shows clear commitment to the Japanese market. This often attracts serious and interested business partners. Japanese companies attend trade fairs to find new and innovative products. If interested, they may speak with you directly at the event. It’s also common for them to gather materials and follow up later in writing.

Making the Most of a Trade Fair in Japan

If you plan to attend as an exhibitor, thorough preparation is essential for maximizing your chance of success. One effective approach is to identify potential Japanese partners through market research and inform them in advance about your participation. Sharing information about your company and products in advance can help attract interest to your booth. Communicating in Japanese is especially effective. Localized, culturally appropriate materials show professionalism and preparation. They can also draw visitors who already know your offerings. Building relationships with such well-informed attendees is often more fruitful than engaging with the general trade fair audience.

How to communicate effectively at a trade fair?

Mind the cultural and language barriers. Even at trade fairs marketed as "international," many attendees and exhibitors may not be comfortable conducting business discussions in English. (Based on our experience at an Trade fair around 1 of 50 Japanese speak fluent English) Trade fairs are a chance to make strong first impressions and form new business connections. Speaking Japanese, even simple greetings, greatly improves engagement. It can also lead to better business opportunities. If your staff do not speak Japanese, deeper conversations may be difficult. In that case, it is best to use Japanese-speaking interpreters. Ideally, assign one interpreter per person.

Do not forget your business cards

One often overlooked but important point when attending trade fairs in Japan is to bring more than enough business cards. The exchange of business cards (meishi) remains a fundamental part of Japanese business etiquette and plays a key role in establishing initial rapport. Running out of cards during a trade fair can be seen as unprofessional or unprepared, and may hinder future engagement. It is advisable to prepare a substantial quantity of high-quality cards, ideally with Japanese on one side. This ensures smooth introductions and leaves a lasting impression.

Do not expect to "have a deal" at the event

Unlike in some Western markets where deals may be finalized on the spot, trade fairs in Japan are primarily about establishing connections and collecting information rather than closing immediate business agreements. Japanese companies tend to take a careful and deliberate approach to business decisions. If they find your offering compelling, they may follow up with you after the event for further discussions.

Therefore, your primary focus at a trade fair should be to make a strong impression, provide comprehensive information, and build trust with potential partners. If your budget allows, you may also consider giving a presentation at an industry seminar held alongside the trade fair. These seminars are often attended by key decision-makers and professionals who are actively looking for new ideas and innovations.

Key Industry Trade Fairs in Japan

Japan hosts approximately 370 trade fairs and exhibitions annually across various industries. Depending on the industry, Japan hosts a wide range of specialized trade fairs that attract both domestic and international participants. Some of the most notable trade fairs include:

- Food & Beverage: FOODEX Japan (Asia’s largest food and beverage Trade fair), Supermarket Trade Show, FABEX Japan, ANUGA Japan

- Automotive: Tokyo Motor Show (Leading event for automotive innovation)

- Healthcare & Wellness: Medical Japan (Showcasing medical and healthcare innovations)

- Technology & Electronics: CEATEC (Cutting-edge IT and electronics trade fair)

- Retail & Consumer Goods: Japan Shopping Festival (Focused on consumer trends and retail opportunities)

Before deciding which trade fair to attend, it's important to carefully check the profile of each event (eg. what products are highlighted). Reviewing the list of companies that have participated in previous years can help determine whether a particular Trade fair aligns with your business goals. Some of the fairs are rather aimed at the consumers, while others are focusing on the professional audience. Choosing the right event ensures that your time and resources are invested where they have the highest potential for impact.

Conclusion

Trade fairs in Japan are more than just industry events—they are a crucial gateway for European companies to establish credibility, gain market insights, and foster key business relationships. By strategically planning your participation and following up effectively, trade fairs can significantly accelerate your company’s market entry and long-term success in Japan.

Ready to Explore Trade Fairs in Japan?

At Sudy & Co., Ltd., we provide comprehensive support to help European businesses maximize their success at Japanese Trade fairs. With experience supporting European companies at FOODEX Japan, CEATEC, Japan IT Week and others, we offer tailored services including pre-event market research, trade fair registration support, localization of marketing materials, business meeting arrangements (even outside of the trade fair), on-site interpretation, and post-trade fair follow-ups. Our expertise ensures that your participation leads to meaningful business opportunities. Feel free to contact us today to explore how we can help you succeed in the Japanese market.

Brief history of the Hungarian Forint

The currency of Hungary is called “forint” which was already in use in medieval Hungary along with other European countries.

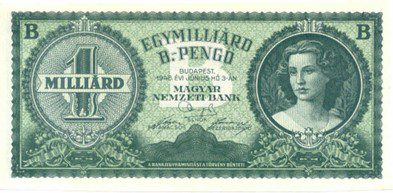

Hungary experienced hyperinflation (the world's highest to date: 1016% per month) in 1945 and 1946 after World War II, and "pengő" [ˈpɛŋɡøː] – the currency adopted in 1927 – had completely lost its value. Thus, forint was reintroduced in August 1946 as a currency to replace the pengő. The subunit of forint is called “fillér” [ˈfilleːr] – 1 forint could be divided into 100 fillers. However, due to inflation and other economic factors after the end of socialism, fillér was put out of use in 1999.

Hungary joined the European Union in 2004. The conditions for joining the EU include adopting the euro, hence it being the common currency of the union, however, no deadline is set in stone within the rule. Hungary has not made this step yet and continues operating with its own currency to this day.

There have been discussions to introduce the euro many times in the past, but after witnessing the Greek government-debt crisis, neither the pros or cons have outweighed each other. The current Hungarian government is reluctant to carry out the measure of adopting the euro, so we can assume that the forint will continue to be used for a while a longer.

The forint is considered to be an "emerging currency" in the world; it is used in the (relatively) small country of Hungary with a population of less than 10 million people. As such, it can be expected to be sensitive to certain global events and exchange rate fluctuations. Forint exchange rates are often shown in pair with the euro on different kinds of platforms, as forint is mostly traded for euro. As of April 2023, 1 EUR = 371 HUF.

Why is the Hungarian Forint becoming weaker and weaker?

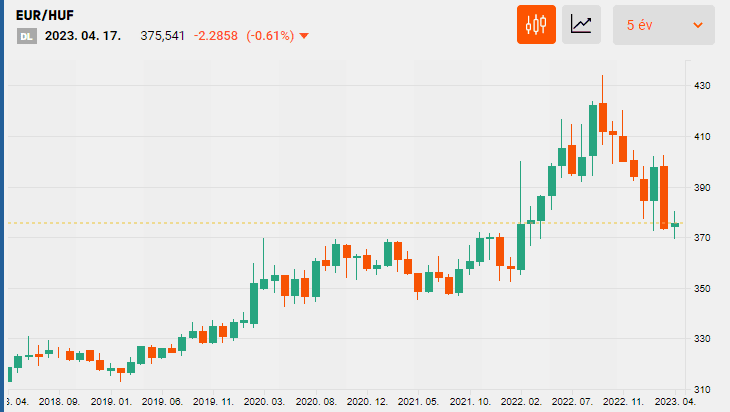

The Central Bank of Hungary, in line with global trends, started adopting a low interest rate policy in 2011. Interest rates stood at 7% in 2011, then were gradually reduced to 0.9% by 2016. They were held steady and low at 0.9% for 4 consecutive years from 2016 to 2020. As a consequence, the forint has been progressively depreciating in this period (300~310 HUF to 1 EUR in 2015, 320~330 HUF to 1 EUR in 2019).

Speaking of the government’s fiscal measures, many policies have been introduced that stimulated demand (such as low-interest loans), so the supply of the forint continued to increase while interest rates remained low. Although it was not acknowledged, the weakening of the Hungarian forint seemed to be part of the country's economic policy.

Since exports are the driving force of Hungary's economy, the forint's depreciation is presumed to have had some positive effects. During the time period mentioned above, Hungary's economic growth was considered to be high, and even though there was inflation to a certain extent (around 2-3%), real wages have also increased. On the other hand, the Hungarian forint's currency value fell 23.81% against the euro between January 2011 and January 2020.

What was the impact of the coronavirus?

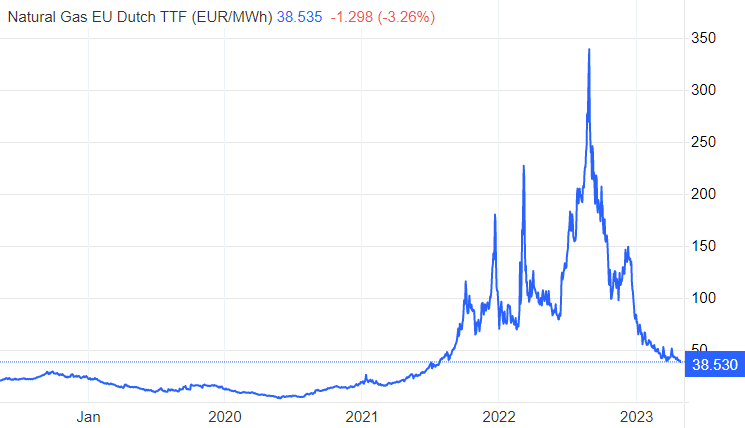

With the start of the global pandemic and economic crisis in March 2020, the Hungarian forint exchange rate swayed. In March 2020 alone, the forint dropped about 8%. After that, it continued to fluctuate up and down, and in October 2022, it fell to the record-low of 1 EUR = 430 HUF level due to the rising prices of the post-corona period, high energy prices, and concerns about the Russian-Ukrainian war that started in February 2022. This represents a further 25.45% drop in the Hungarian forint exchange rate compared to January 2020. This time, forint depreciation seemed unstoppable. The forint was among the world's worst performing currencies.

How did the Hungarian Central Bank respond to the sharp exchange rate depreciation?

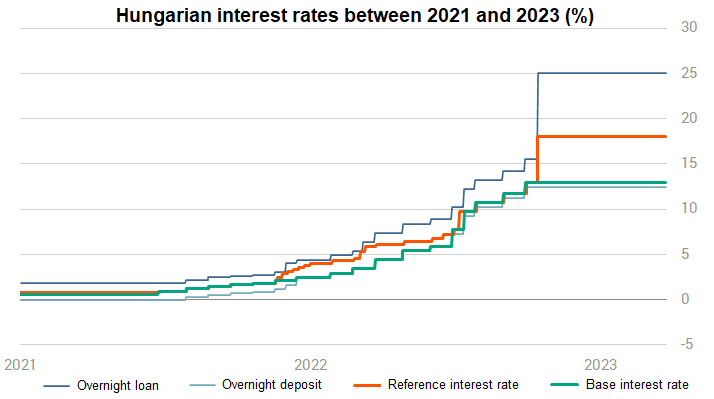

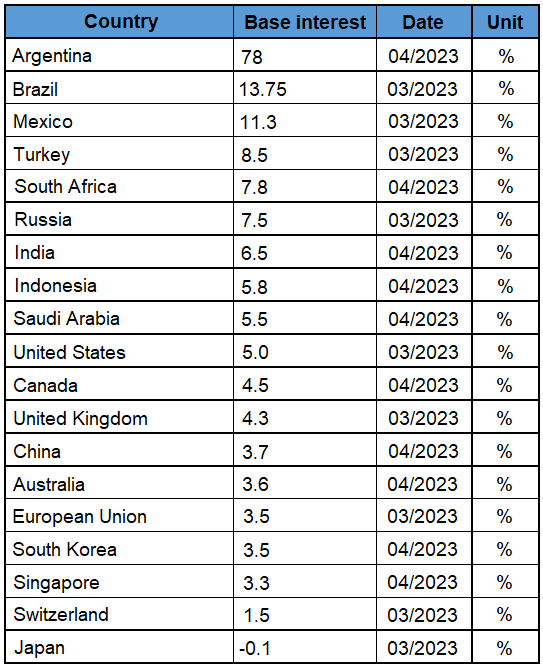

After June 2021, interest rates began to rise in inverse proportion to the Hungarian forint's exchange rate. The base rate was raised from 0.6% to 13% between July 2020 and September 2022 – in a mere 2 years. However, as of April 2023, the overnight interest rate is 18% which is currently functioning as the actual interest rate (reference interest rate). At the moment, Hungarian interest rates are considered to be high in terms of global comparison, too.

For a long time, the Hungarian Central Bank's interest rate hike could not stop the Hungarian forint from falling. The base rate peaked at 13% in September 2022, and the forint kept falling despite the overnight rate rising to 18% in October the same year.

The forint exchange rate started improving after energy prices fell in December 2022 and visible signs pointing to the end of the European energy crisis were seen. Hungary is extremely dependent on imports, especially energy – which is generally purchased with foreign currency. This means that when energy prices are high, the purchasing demand for Hungarian forint on the currency market rises, which negatively affects its exchange rate.

The setting of higher interest rates has taken effect once concerns about energy supplies eased in 2023. The Hungarian forint strengthened by 7% against the euro and 9% against the US dollar between January and April 2023. In contrast to 2022, the first half of 2023 was the time of the forint revival.

There are many uncertainties about how the Hungarian forint rate's currency power will change in the future. The tightening monetary policy of the Hungarian Central Bank has led to higher interest rates on various loans in Hungary, and the burden of government bonds has increased as well. Also, high interest rates generally have a slowing effect on a country's economy. Therefore, there is strong pressure put on the central bank by the government to lower high interest rates.

However, Hungary's Central Bank is in an even more difficult position, since domestic inflation is still high. Unless major economies will not start cutting interest rates, preceding these countries with lower interest rates could trigger yet another wave of depreciation for the Hungarian forint.

Therefore, economic trends around the world, Hungary's inflation rate, and the rise of energy prices in 2023 will be the most important factors impacting the Hungarian forint in the coming years. The same way Hungary has to coexist with other countries as an open economy – in the sense that Hungary has a narrow domestic market and it mainly relies on trade –, its currency, the forint, is also destined to be affected by global trends in general.

How does the change in the Forint’s currency power affect foreign companies in Hungary?

The depreciation of the Hungarian forint between 2011 and 2020 was moderate, and in some ways, predictable. This was also beneficial for foreign companies investing in Hungary making their financial planning in EUR, USD or JPY. For example, Hungarian salaries have risen, but only in HUF – in EUR, the amount has stayed almost the same. Hungary's forint-denominated domestic service inflation was also less impactful than expected.

On the other hand, Hungarian forint exchange rate fluctuations have been wild and difficult to predict since 2020. Not knowing how the currency power changes makes financial planning difficult and poses a management risk – in the long run, a stable rate is more desirable. This applies to foreign and Hungarian companies as well.

Considering that energy prices have now stabilized to a certain extent, it is assumed that there will be fewer sudden changes in the Hungarian currency's value. Plus, given the long-term trends, the forint still has a bigger possibility to fall instead of rising, which could be beneficial factor for future investors.

Sources

- https://hu.wikipedia.org/wiki/Magyar_forint

- https://hu.wikipedia.org/wiki/Magyar_peng%C5%91

- https://portfolio.hu/

- https://tradingeconomics.com/commodity/eu-natural-gas

- https://tradingeconomics.com/country-list/interest-rate

If you have any questions, please feel free to contact us!

If you are interested in hearing more information about the current state of economic circumstances, market conditions and business opportunities in the Central and Eastern European region including Hungary, contact us!

Japan's aging society has been a hot topic for the past few decades due to the massive labor shortage occurring in most industries, whether it be service, manufacturing, agriculture, construction or healthcare. The country is still managing to make ends meet – but how? In this article, we are going to introduce 4 ways Japan’s HR business has responded to this problem in the past decade.

It’s necessary to understand the background of why these business practices were born in the first place, so let’s talk reasons and numbers.

What were the main factors that the HR industry had to adapt to?

Aging population, low birthrate

If someone mentions this expression, we can confidently say that Japan is what comes into people’s minds first, and unfortunately, that is no wonder. Based on the data collected by the Japanese Cabinet Office in 2020, elderly citizens made up 28.4% of the population in 2019, and this number is predicted to increase even more in the following decades. This is a phenomenon that can be observed in developed countries in general due to the progressing of industrial revolutions and the changes occurring in family structures. However, Japan’s aging can also be accounted for the following 2 factors:

- declining number of deaths of citizens aged 65+ due to the improvement of life circumstances and medical practices after World War II

- declining number of births. The current fertility rate is 1.42 births per woman (age 15-49).

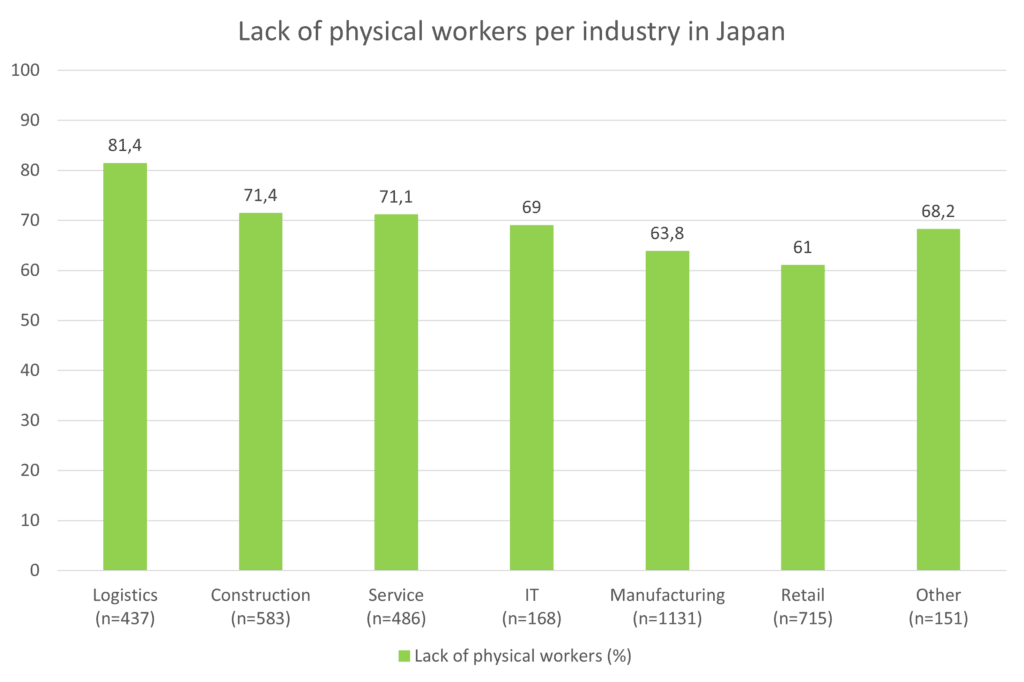

Lack of physical labor

In order to respond to the problems mentioned above, Japan started working on both long-term and short-term counteracting measures.

- In the long run, the country needs to find ways to increase birth rates.

- For now, increasing participation rate of women and the elderly in labor make up for the lack of workforce – temporarily.

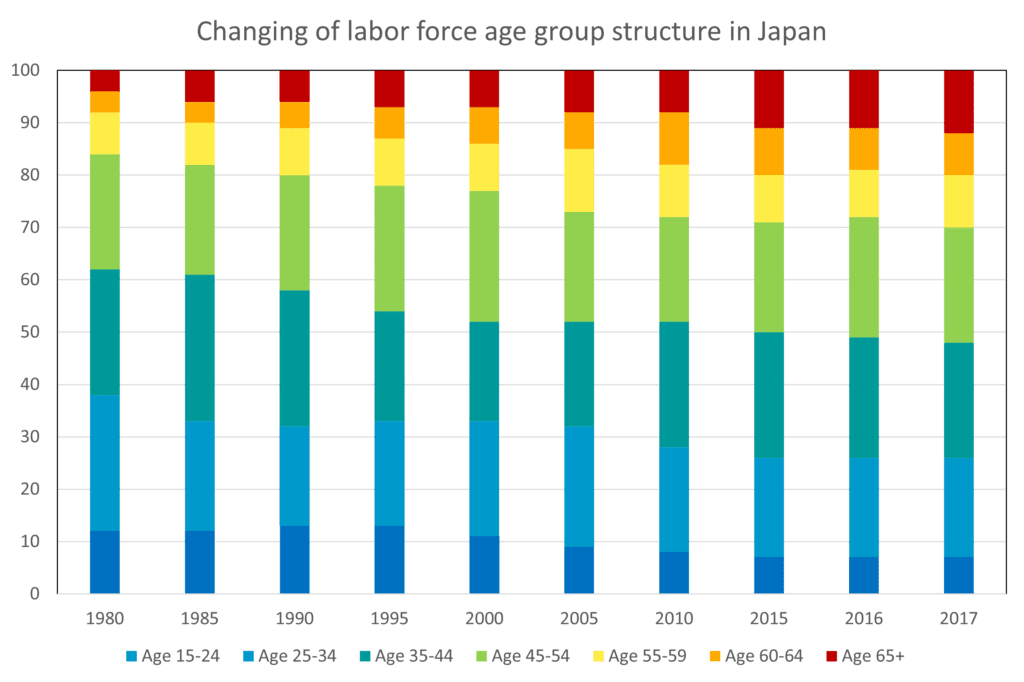

However, working circumstances such as hard physical work and working at odd hours (nights or very early mornings) can mainly be endured by younger people – which the country lacks at the moment. In the past 4 decades, the number of young workers (age 15-44) gradually decreased due to the declining birthrate, while the rest of the age groups have slowly become the majority.

What HR business solutions were born in order to face labor shortage experienced all over Japan?

1. Sending organizations for „Specified Skilled Workers”

In recent years, Japan has opened its arms wide for foreign workforce to enter the country in order to make up for the lack of workforce in industries that are most struck by it. The country created a special type of visa in 2019 called the „Specific Skilled Worker” visa that foreign workers of certain professions who wish to live and work in Japan can apply for.

These 5 industries have been selected first to accept visa applications from skilled individuals for:

- Construction

- Shipbuilding and ship machinery

- Accommodation

- Nursing care

- Agriculture

Later, the following 9 industries were also added to the target list:

- Building cleaning management

- Raw materials manufacturing

- Machine parts and tooling

- Electric, electronics and information technology

- Automobile repair and maintenance

- Aviation

- Fishery and aquaculture

- Food and beverage manufacturing

- Food service

Since applying for the visa, getting to a certain level of Japanese proficiency in order to be able to take a language test and a skill test, and finding a sponsor company that provides employment can be difficult to do all alone from a foreign country, so called „sending organizations” (送り出し機関, okuridashi kikan) have been established in order to provide support for potential workers.

These agencies are particularly common in Southeast Asia, in countries like Vietnam, Indonesia or Cambodia, and have to be approved by the Japanese government. Their business model includes taking a certain commission fee from the Japanese companies that are seeking foreign employees with special skills, and also taking a representative fee on top of obligatory fees (such as the cost of a Japanese language exam, skill exam, paperwork, etc.) from the individuals who wish to work in Japan.

2. Employing the elderly – „Silver work”

As it was already mentioned before, the elderly (people aged 65+ in this context) make up almost one-third of the Japanese population. However, according to a recent survey conducted by Nippon Life Insurance Co., almost 64% of Japanese are willing to work even after reaching the age of retirement, which creates new opportunities to fill the gap labor shortage is causing on the market.

In recent years, certain organizations emerged in order to recruit and provide paid part-time work for retired-age citizens who wish to remain active and earn a bit of additional income. This not only helps dealing with the problem of workforce issues to a certain extent nation-wide, but also supports elderly people with staying motivated and social in their daily life. Recruited members of such an association can choose how much they want to work in a week freely, and may also try several different kind of jobs that they may have not challenged before, gaining new knowledge and skills.

3. Temporary staffing – „Haken”

Temporary staffing or personnel leasing (派遣, haken) is not a recently invented employment type in Japan. However, as labor shortage began to drastically worsen over the past decade, certain industries started relying more and more on the services of temporary staffing companies – the convenience store industry being one of them. Konbini chain owners are struggling with lack of staff to a point where they have to consider ending their 24/7 business policy because they don't have enough employees to make ends meet in terms of managing shifts. Finding new employees always takes time and money – recruitment costs are one thing, but training a new staff member who has no working experience in a konbini and hoping they won't quit too soon is another big issue.

In response, some convenience store franchises took solving this problem to a level where they co-established their own temporary staffing company in order to fulfil their specific needs in human resources. A great example for this would be one of the biggest convenience store chains, Lawson, which has its own haken company called Lawson Staff. Temporary staff members who are recruited to the company receive full paid training before being dispatched to stores struggling with empty shifts. Lawson Staff has even developed its own software so its employees are able to browse shifts freely based on their preferred location, working time, store, and many other conditions, which is creating more flexible opportunities for full-time and part-time temporary staff members.

4. Gig work – „Tanpatsu/tanjitsu baito”

Gig work is not a fresh concept globally, but it is something quite new that only has been introduced to Japan through some innovative platforms in the past few years. Gig jobs, or "one shot/one day jobs" in Japanese (tanpatsu baito or tanjitsu baito, 単発バイト・単日バイト) can be done by anyone who has some time on their hands and a need for quick money.

3 examples for platforms specializing in one day work in Japan are Shotworks, Timee and Matchbox. All websites offer a variety of jobs in all kinds of industries: logistics (packing, packaging, driving), manufacturing (assembling parts), service (convenience store, restaurant or shop staff), office work (administration, filing, documenting, scanning), even agriculture, seasonally (picking) and many more. Gig jobs and temporary staffing jobs are both very popular among students, stay-at-home mothers, foreigners and "freeters" (フリーター, furiitaa: someone who prefers not having a regular full-time job and working whenever and whatever they want).

Japan’s labor shortage problem may result in even more hardships and challenges as population continues to decline in the following years, but luckily, new solutions available on the HR market are – and hopefully, will still be – able to offer a sense of relief to Japanese businesses in trouble.

Need some help with your own business?

We have been working together with our consultants and partners since 1999 towards creating more business opportunities between Japan and the CEE region.

If you are also looking to enter the Japanese or the CEE market with your organization, feel free to contact us for consultation by clicking here!

Sources

- 中小企業庁編(2018)『中小企業白書:人材不足を乗り越える力:生産性向上のカギ』東京:日経印刷.

- 内閣府(2020)『高齢化の状況及び高齢社会対策の実施状況』- https://www8.cao.go.jp/kourei/whitepaper/w-2020/zenbun/02pdf_index.html

- 上林千恵子(2019)『「人手不足」と外国人労働者:特集にあたって:日本社会の高齢化と外国人労働者の受け入れ:建築業・介護サービス業・農業の事例から』大原社会問題研究所雑誌「第 729 巻」pp. 1-9. 法政大学大原社会問題研究所.

- Japan Times: 64% in Japan willing to work beyond retirement age, survey shows (09/21/2020) - https://www.japantimes.co.jp/news/2020/09/21/business/survey-work-retirement-age/

- Reuters: Closing time? Japan convenience stores pressed to end 24-7 model amid labor crunch (03/21/2019) - https://www.reuters.com/article/us-japan-retail-convenience-idUSKCN1R12Y8

- Support Website for the Specific Worker Program - https://www.ssw.go.jp/en/